We’re Everly. We see life differently.

ABOUT US

Who we are

At Everly, we’ve put a tremendous amount of thought into creating the kind of life insurance you might design for yourself. One that’s Made for Living™.

Our solutions give you the freedom to use your policy throughout your life for the things that matter to you.

We educate you, so you understand how your policy works, empower you to take full advantage of your policy’s benefits, and give you the tools you need to help you live life on your terms.

Yes, we’re changing the paradigm. Because we believe what truly matters is different for everyone.

ABOUT US

What we stand for

At Everly, our principles are a set of guidelines that shape our culture, decision-making processes, and business practices.

Make things that matter.

Make meaningful connections.

Make it work WAY better.

ABOUT US

Our values guide our culture

Break down barriers

Radical transparency is a way of being. We have nothing to hide, we dismantle the fear and uncertainty surrounding life insurance, and we build trust and long-term relationships.

Embrace the journey

Life insurance isn't just a transaction; it's a journey. We are committed to being present, empathetic, and supportive to our policyholders, every step of the way.

Own the outcome

We take our responsibility to our customers, our partners, and ourselves, seriously. We’re up front about our successes and mistakes, so we can continually learn and improve.

Spark some joy

Joy is baked into our culture. We find and share joy with each other, our policyholders, and our partners, making the entire life insurance process more pleasant and positive for everyone.

ABOUT US

The company story

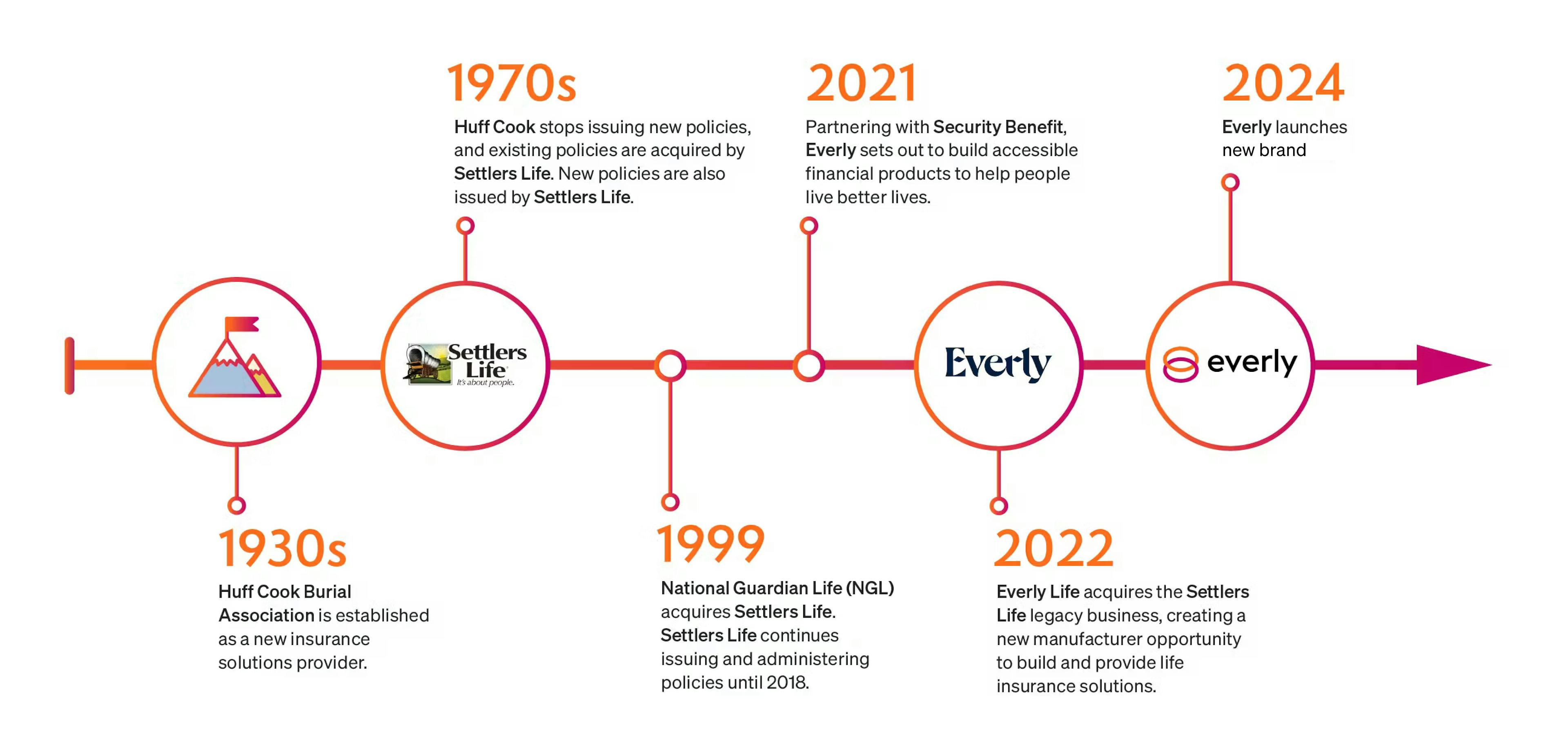

Launched in 2021 by a company with nearly a century of life insurance expertise, Everly Life unites a forward-thinking approach with cutting-edge digital technology.

ABOUT US

Financial strengths

With $433M assets under management* (AUM) we stand on stable ground.

AM Best gives us an Excellent A- Rating for financial strength.

We’re licensed coast to coast, in 49 states.**

Over 200,000 policyholders.*

*As of Q1 2024

+A.M. Best’s 15 ratings are a measure of claims-paying ability and range from A++ (Superior) to F(in Liquidation). Ratings are current as of January 25, 2024 and are subject to change at any time. While ratings can be objective indicators of an insurance company’s financial strength and can provide a relative measure to help select among insurance companies, they are not guarantees of the future financial strength and/or claims-paying ability of a company and do not apply to any underlying variable portfolios. The insurance agency from which a policy is purchased, and any affiliates of those entities, make no representations regarding the quality of the analysis conducted by the rating agencies. The rating agencies are not affiliated with the above-mentioned entities, nor are these entities involved in any rating agency’s analysis of the insurance companies.

**We are not licensed in NY.